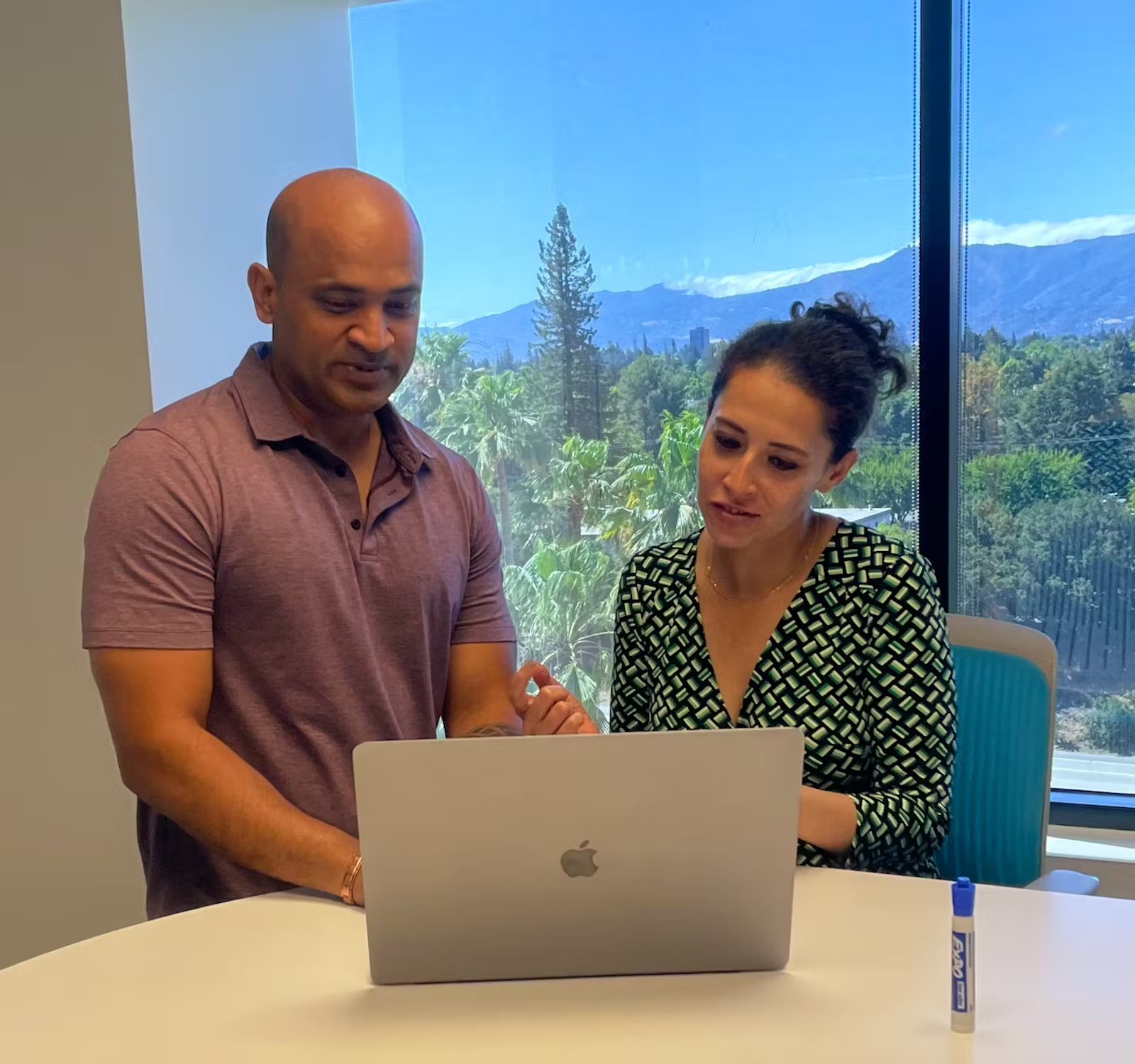

Today, we are thrilled to congratulate TheLoops co-founders Somya Kapoor and Ravi Bulusu, and their entire team on a remarkable milestone: their acquisition by IFS, a global leader in enterprise software. This landmark achievement is not just a testament to the team's incredible vision and execution, but also a powerful validation of a shared belief in the transformative power of AI to revolutionise customer experience operations.

For us at Tidal Ventures, this is a moment of immense pride. We are honoured to have been a partner to TheLoops since their 2020 Seed round, and this outcome is a brilliant success for the founders, the team, and our investors.

Investment principle: Backing founders with domain expertise

When we first met Somya and Ravi, we saw an accomplished, product-led duo with deep domain expertise. Somya's experience leading product management at ServiceNow, combined with Ravi's background in AI at Splunk and as a multi-time founder, immediately stood out. They had identified a critical and growing pain point: customer support operations were overwhelmed, and existing tools weren't fit for purpose.

As we wrote in our original investment notes, our conviction was rooted in bringing the principles of observability to the front office. For too long, customer success and support had been a black box. We saw a powerful opportunity: what if you could make these operations observable, turning a traditional cost centre into a company's primary growth driver? TheLoops was the answer. Their platform was designed to bring the context, collaboration, and intelligence needed for true observability, empowering teams that had been left behind by modern data tools. We knew this approach would deliver a true step change in the customer experience, and that founders Somya and Ravi were the killer combination with the deep domain expertise to make it happen.

A shared vision realised

TheLoops has executed on this mission with passion and precision, evolving into a leader in AI Agents for the next era of Customer Success. Their platform doesn't just assist agents—it amplifies their expertise. By delivering intelligent routing , proactive insights, and knowledge that evolves with every interaction. Imagine knowing what happened in a customer product interaction when a ticket is opened without them having to explain it! TheLoops has empowered businesses to resolve complex cases faster and more consistently and in turn scale customer operations.

This journey culminates in today’s acquisition by IFS. The strategic fit is undeniable. As a customer of TheLoops, IFS experienced the power of their AI-driven platform firsthand. IFS shares TheLoops' vision for the future of Autonomous AI Agents and provides the global scale and resources to accelerate this mission.

Validating the AI-driven strategy

This successful exit demonstrates the power of Tidal’s investment strategy. Software and AI startups can create immense value and generate strong, early returns with differentiated, AI-driven products that attract significant buyer interest. TheLoops built a platform with compelling intellectual property that delivers tangible ROI, proving that a company with a distinct technology advantage can achieve a great outcome.

This is a formula we believe in, and it is just the beginning. We are proud to see our Seed II portfolio company's successes and are actively replicating this strategy in our Seed III fund, backing companies with cutting-edge AI, real technology advantages, and rapid global potential.

We want to extend our deepest gratitude to Somya, Ravi, and the whole team at TheLoops. Thank you for your relentless hard work and for including us on this incredible journey. We are delighted to have partnered with you and will be cheering you on in your next chapter with IFS.

.avif)